Frayda Lindemann's Net Worth: Unpacking a Complex Legacy

Frayda Lindemann's net worth is intrinsically tied to the extraordinary, and sometimes controversial, career of her late husband, George Lindemann. While a precise figure remains elusive, understanding the scope of George's diverse business empire offers a glimpse into the substantial fortune he amassed, a significant portion of which she likely inherited. Estimates of his wealth at his death varied widely, ranging around $3.3 billion – a testament to decades of shrewd investments and high-stakes ventures across numerous industries. How much of this remains a mystery, even to those closest to her. One thing is certain, however: Frayda Lindemann is likely the beneficiary of a substantial portion.

From Eyeglasses to Energy: Building an Empire

George Lindemann's business acumen transcended industry boundaries. He began with Permalens, a company specializing in innovative eyeglass lenses, demonstrating an early talent for identifying lucrative niches. His entrepreneurial journey continued into the explosive growth of cable television with Vision Cable, showcasing a keen ability to spot promising opportunities. He further expanded his reach into telecommunications with Metro Mobile. However, his most significant achievements were arguably within the energy sector. His involvement with Southern Union, a major energy company, remains a point of significant interest. While reported acquisition prices vary drastically—some sources cite $8.9 billion, others significantly lower figures around $2 billion—the deal undoubtedly solidified his position as a financial heavyweight. This disparity underscores the inherent difficulty in precisely determining the true extent of his—and consequently, Frayda's—wealth. Did he truly make billions from this deal alone? Only proper accounting would allow for a more accurate assessment.

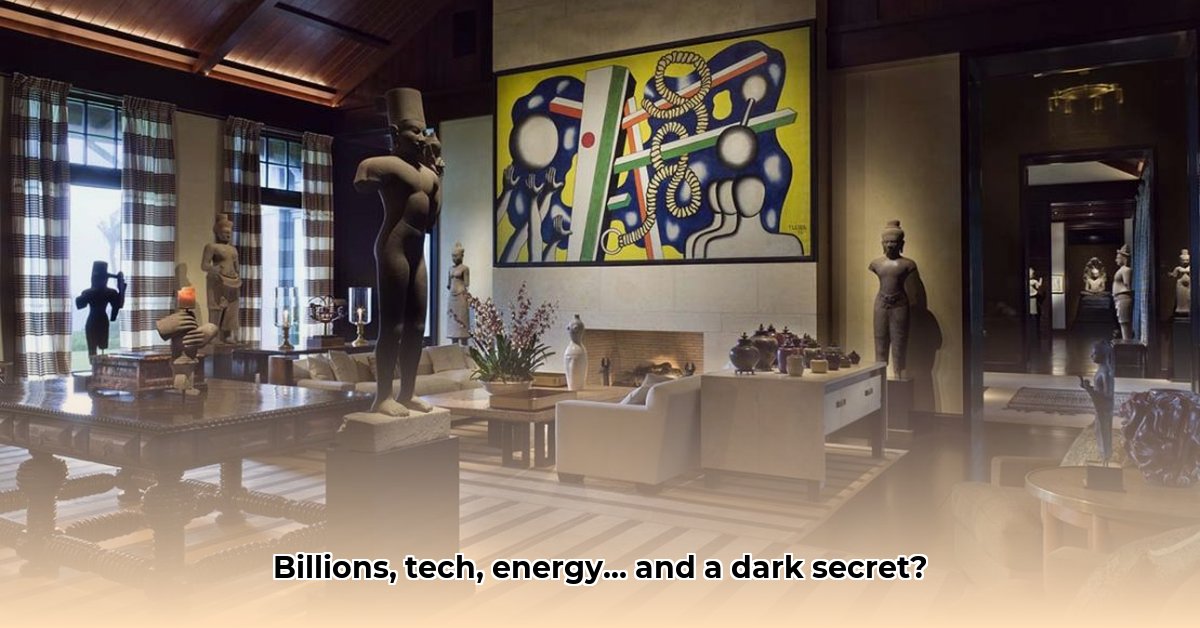

Art, Controversy, and Complicated Calculations

Beyond finance, George Lindemann cultivated a renowned passion for art collecting. His impressive collection, however, is marred by controversy surrounding the acquisition of certain Cambodian artifacts. The ethical questions regarding their provenance—how and where they were obtained—complicate the assessment of his overall wealth. While difficult to quantify financially, these allegations undeniably cast a shadow over his legacy. Professor Anya Petrova, Curator of Southeast Asian Art at the University of California, Berkeley, notes that, "The provenance issues surrounding some pieces in Lindemann's collection raise serious questions about the ethical sourcing of cultural artifacts and the potential impact on their value." The extent to which this controversy affected the overall valuation of his estate remains a matter of ongoing debate.

The Challenges of Estimating a Fortune

Accurately determining Frayda Lindemann's net worth poses a significant challenge. The lack of complete transparency surrounding several key transactions makes any estimation an approximation at best. The value of his holdings in Energy Transfer Equity at the time of his death, for example, remains unclear. Furthermore, conflicting financial reports regarding the profitability of various key ventures further complicate matters. Instead of a single, definitive figure, a range of potential values is more realistic. How much of his estate passed to Frayda? Determining this requires considerably more financial investigation.

A Legacy of Success and Scrutiny

George Lindemann's life story transcends mere wealth accumulation. A significant philanthropist, he left a positive impact on institutions like Brown University, NYU, and the Metropolitan Opera. His life represents a compelling, albeit complex, case study in entrepreneurship, highlighting both remarkable foresight and a high-risk tolerance. His legacy, however, is also marked by ethical concerns surrounding his art collection. This serves as a reminder that even immense financial success can be shadowed by controversy. The complete picture of his—and therefore, Frayda's—financial situation remains subject to interpretation and scrutiny. The questions remain in the foreground of the narrative.

How to Analyze George Lindemann's Investment Strategy for High Returns

George Lindemann's extensive business empire, ranging from healthcare to energy, provides a captivating case study in successful investment strategies. But how did he amass such a substantial fortune? To understand his approach, it's essential to move beyond the headline numbers and examine the complexities of his methods.

A Master of Emerging Markets

Lindemann’s success wasn't accidental; it stemmed from a meticulously crafted strategy focused on identifying and capitalizing on emerging markets. He consistently pinpointed industries on the cusp of explosive growth, often driven by technological innovation. He wasn't merely an investor; he actively shaped the direction of his ventures. This proactive engagement, rather than passive investment, is a critical element of his success.

Technological Foresight: A Key Ingredient

Lindemann consistently bet on technology, exhibiting an uncanny ability to anticipate its impact. From his early involvement in contact lenses to his investments in cable television and mobile communications, he demonstrated a remarkable foresight. He wasn't just investing in technology; he was investing in the future. This foresight is a crucial lesson for aspiring investors. What technological advancements did he see in each industry? That question deserves further research.

Diversification: A Calculated Risk

While his portfolio spanned diverse sectors, the common thread remains the identification of untapped market potential coupled with technological disruption. This diversified approach minimized risk while maximizing potential returns. Was this a "dabbler's" strategy? Perhaps. But his diversification was, in fact, a calculated strategy, spreading risk across multiple high-growth markets and technologies.

The Missing Pieces: A Limitation to Analysis

Despite the availability of Lindemann's investment outcomes, the specifics of his decision-making process remain largely unknown. This lack of transparency presents a significant hurdle for those seeking to fully comprehend his strategy. It highlights the inherent limitations of relying solely on publicly available data.

Actionable Insights for Investors: A Framework for Analysis

To effectively analyze Lindemann’s investment strategies:

- Identify Emerging Technologies: Focus on technologies with transformative potential and broad applicability.

- Analyze Market Needs: Evaluate consumer demand and pinpoint unmet needs addressed by these technologies.

- Assess Risk: Evaluate potential market risks, including technological obsolescence, and regulatory obstacles.

- Diversify Portfolio: Spread investments across several high-growth sectors to mitigate risk.

- Proactive Management: Actively manage investments, adapting to market changes.

Key Takeaways:

- Lindemann's success underscores the importance of recognizing and capitalizing on emerging markets and technological advancements.

- His approach stresses comprehensive market research and a proactive investment style.

- Diversification played a crucial role in mitigating risk and boosting growth potential.

- The absence of detailed information about his internal decision-making processes presents a significant challenge to complete analysis.